What Is “Pre-Pipeline”? And Why Revenue Problems Start Earlier Than You Think

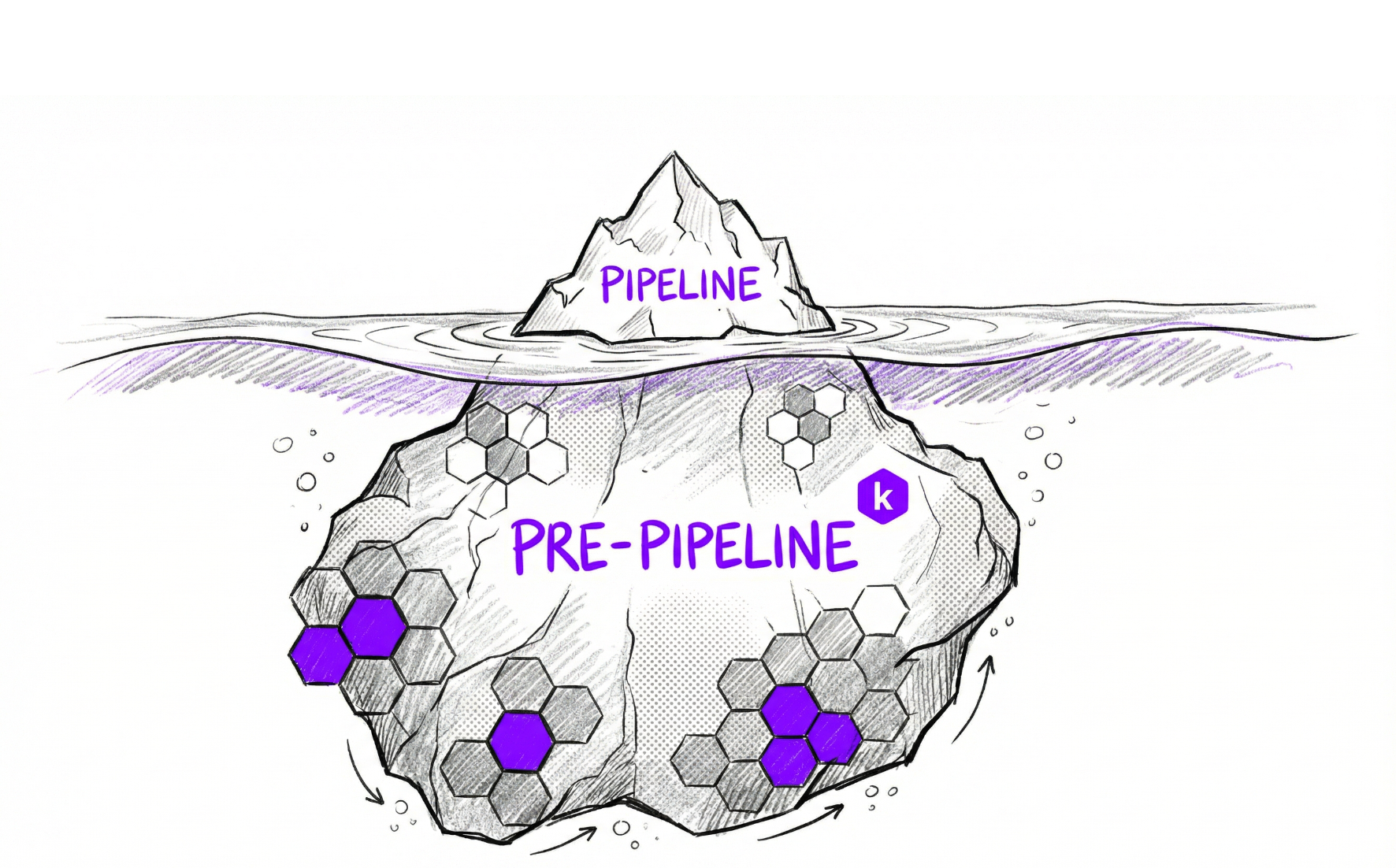

When people talk about generating revenue in B2B companies, they usually focus on the “pipeline”, meaning the qualified sales opportunities inside the CRM that sellers are actively working through deal stages, forecasting, and closing.

In most companies, pipeline is treated as the beginning of revenue creation. When an opportunity enters HubSpot or Salesforce, revenue is now “in motion” and the system kicks in: forecasting updates, SE involvement, deal strategies, MEDDIC, mutual plans, and so on.

But pipeline is not the beginning. It’s the midpoint aka the visible portion of revenue.

A steady pipeline doesn’t just materialize from nowhere. Before any opportunity shows up in HubSpot or Salesforce or Zoho CRM, someone had to answer critical questions:

- Who should we target?

- Which companies are in-market?

- Who inside those companies matter (the buyer group)?

- When is the right moment to reach out?

- What message will resonate?

- Which channels should we use?

- Who reaches out first: Sales or Marketing or Partners?

Today, those decisions are either made informally or by default: based on gut feel, outdated playbooks, or whoever shouts loudest in the pipeline review. Teams stick with “what worked before” instead of testing what actually works now.

This is where the old model breaks.

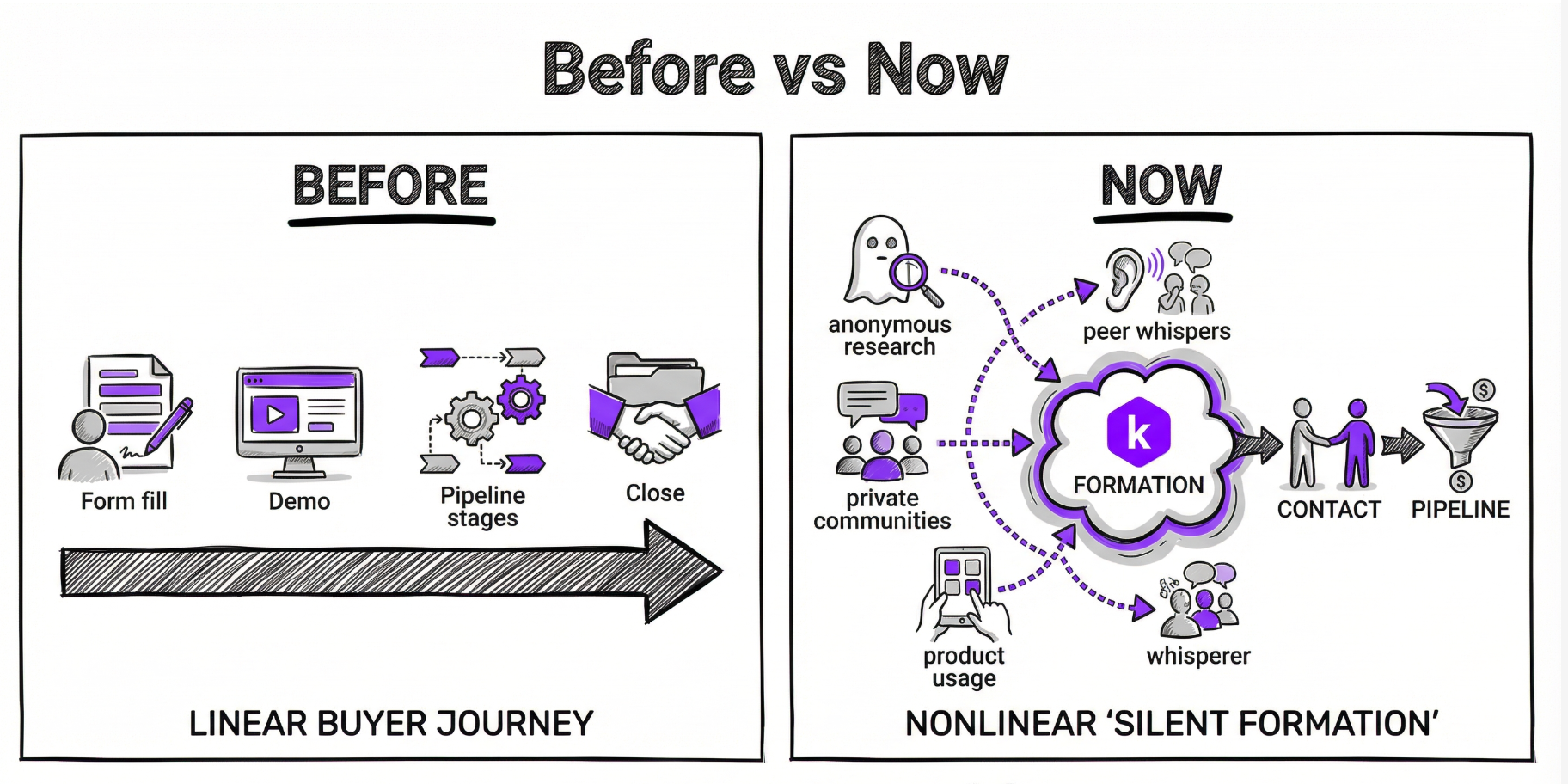

Before vs. After: The Shift Nobody Talks About

Before, pipeline felt like the start of revenue because prospects declared intent visibly. They filled out forms, downloaded content, replied to outbound, asked for demos, and progressed linearly.

But now, buyer groups form silently and asynchronously. Timing windows open and close before Sales ever sees them. Most signals are dark, distributed, and indirect — they happen in private communities, anonymous research, product usage, and whispers between peers.

Deals no longer begin at the point of contact. They begin at the point of formation.

Pipeline is where revenue is measured.

Pre-pipeline is where revenue is made.

Pipeline is the visible outcome.

Pre-pipeline is the invisible system that produces it.

This is the “pre-pipeline” gap.

What is Pre-Pipeline?

Think of it this way: You’re not selling in a store where customers walk in ready to browse. You’re searching for buyers scattered across an entire city.

Some are thinking about buying.

Some don’t know they have a need yet.

Some are actively researching solutions.

Some are talking to your competitors.

Before your sales team makes contact, a lot has to happen:

- Identify who they are

- Figure out which ones are likely to buy

- Know when they’re most receptive

- Decide how to approach them

That whole phase of figuring out who, when, and how is what we call pre-pipeline.

Pre-pipeline is all the work that happens before sales conversations start. It’s not flashy, but it’s where revenue actually begins.

Why This Matters Now, More than Ever

In the past, buying was simple: one decision-maker, one budget. SDRs could spray email lists or rely on inbound leads.

Today, B2B buying looks very different:

- Buying groups average 6–10 people

- People research anonymously and walk away from gated content

- Intent signals are scattered across dozens of sources

- Companies move in waves, not steady steps

Deals no longer start when someone fills out a form for a whitepaper download or opens a cold email. They start much earlier, in research, conversations, hiring patterns, product usage signals, and private Slack groups.

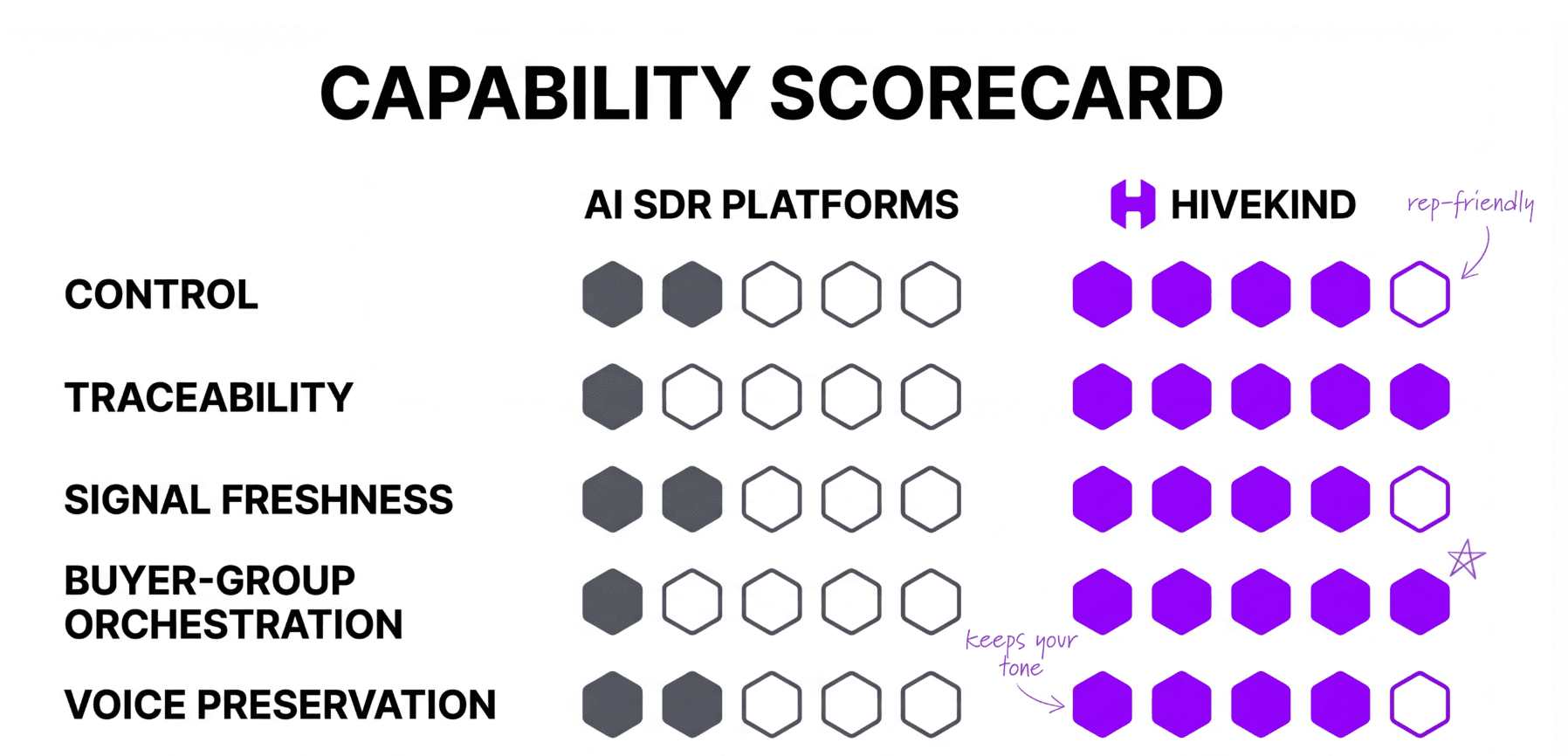

The current tools for GTM were not designed for this world. They either:

- wait for leads (inbound)

- force campaigns with weak or delayed signals (ABM)

- spray-and-pray generic sequences (SDRs)

- score leads after they have entered the pipeline (RevOps)

None of them actually decide who to target, when to engage, or how to coordinate across a buyer group.

Where the GTM Stack Breaks Down

For RevOps and CROs, the modern GTM stack has two fundamental problems:

1. Decisions are made upstream, but tools are downstream

Upstream decisions i.e. who to target, when, and how determine whether pipeline forms at all.

But downstream tools execute after the decision is already made.

Nobody owns the upstream layer.

2. The GTM system doesn’t learn

Most GTM motions reset after a campaign ends. SDRs and Marketing run one-offs. There is no persistent feedback loop, no continuous learning, and no compounding of knowledge.

So What Exactly Is Pre-Pipeline?

Pre-pipeline is the discipline and system that:

Detects signals → decides who to engage → coordinates outreach and timing → learns from interactions

Before opportunities enter pipeline.

Pre-pipeline has three pillars:

1) Detect

Signals that indicate buying intent or readiness across:

- Intent providers

- First-party product usage

- Website behavior

- Content consumption

- Hiring and org changes

- Tech stack shifts

- Funding movements

- Dark social + community cues

The point isn’t the signals themselves. It’s the interpretation of them, in real time.

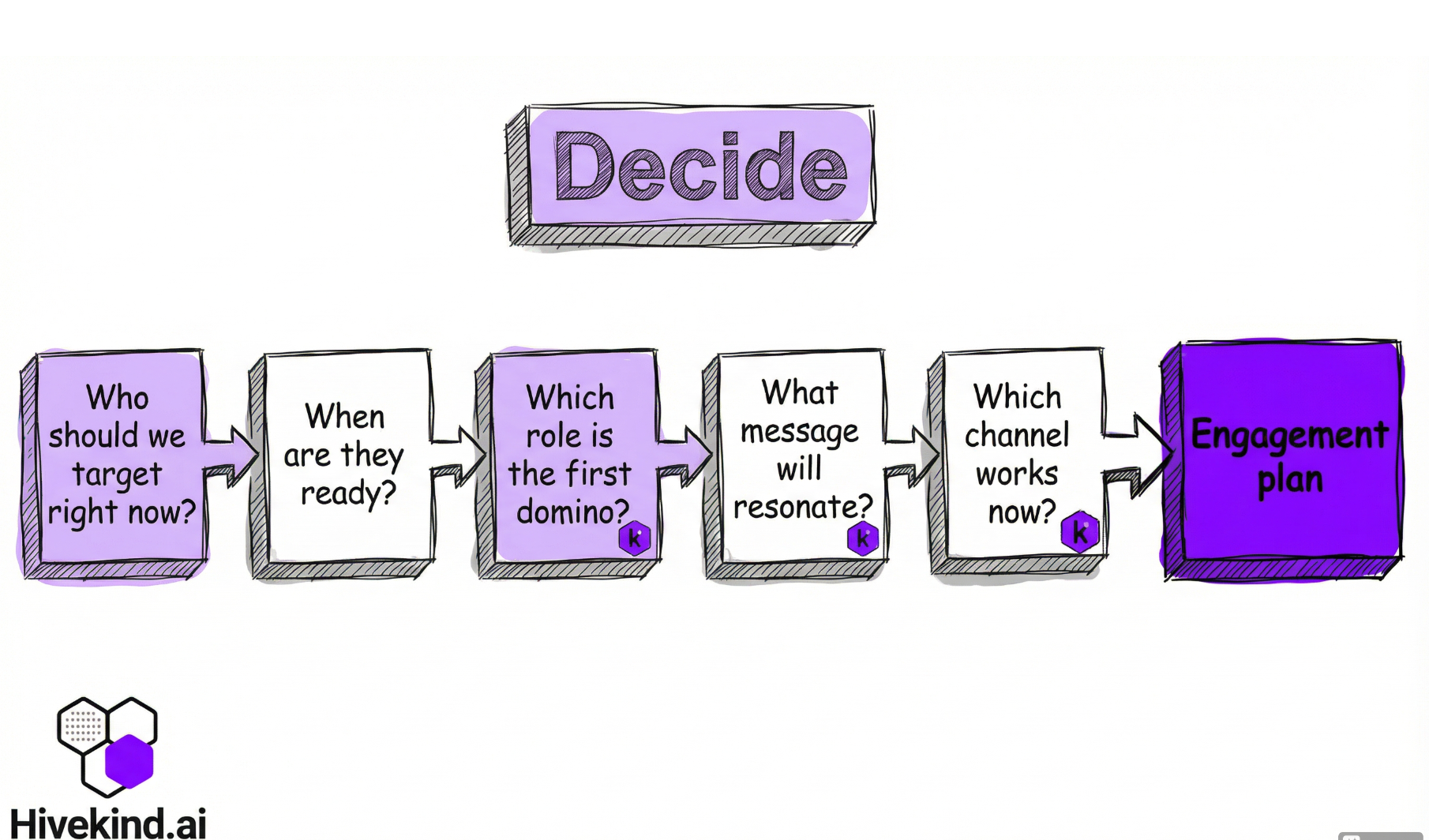

2) Decide

Pre-pipeline’s most essential job is deciding:

- Who should we target right now?

- When are they ready?

- What message should we use?

- Which role is the first domino?

- Which channel is most likely to work when?

Today those decisions are tribal knowledge, SDR intuition, spreadsheets, or gut feel.

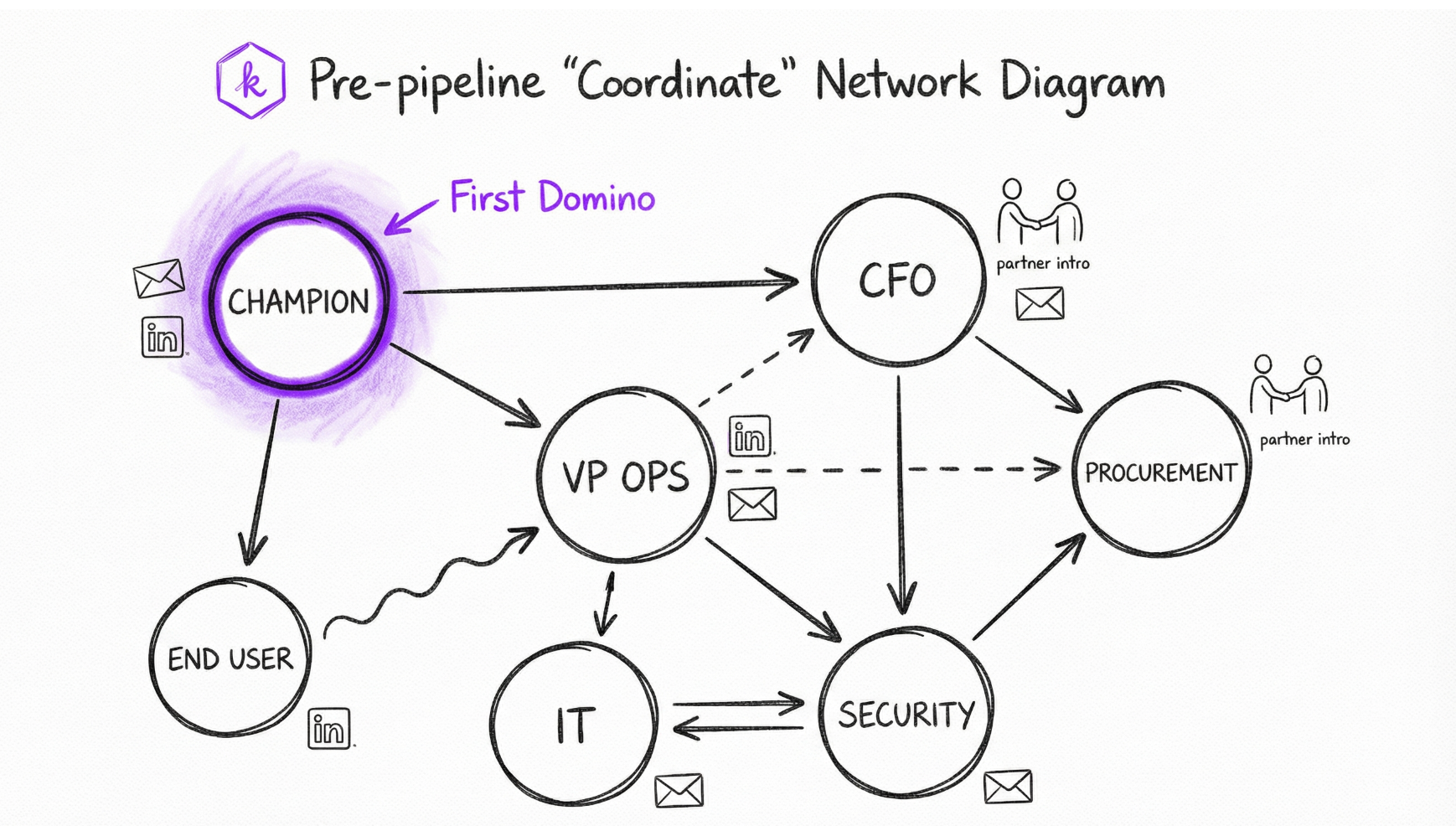

3) Coordinate

Most SDR tools treat buyers as individuals. Modern buying groups are a network.

Pre-pipeline coordinates multi-role outreach so conversations don’t stall because the wrong stakeholder was engaged first or a key stakeholder was left out.

No

How Pre-Pipeline Differs From ABM, Intent, and Sequencers

“Is this just ABM? Or is this just intent scoring? Or better sequencing?”

No.

Static ABM asks:

Who do we care about this quarter?

Sequencers ask:

What do we say and for how long?

Intent tools ask:

Who is showing behavior?

Pre-pipeline asks a deeper and more dynamic question:

Is this account possibly buying nowand should we engage right now?

That question is the difference between:

Reactive pipeline creation ↔ Predictive calculated pipeline formation

Why the Category Matters to CROs

If you ask any CRO what keeps pipelines unpredictable, it’s rarely close rates. It’s upstream formation.

Pipeline volatility comes from:

- missed timing windows

- over-reliance on inbound

- SDR capacity issues

- role mis-sequencing

- delayed multi-threading

- static targeting lists

- signal blind spots

- lack of persistent learning

Pre-pipeline directly attacks those failure points.

Why It Matters to RevOps and Growth Leaders

RevOps has unintentionally become the custodian of patchwork:

- stitching intent feeds

- normalizing data providers

- building scoring models

- building enrichment workflows

- running attribution logic

- feeding SDR lists

- building sequences

- triaging channels

But RevOps tools don’t decide when buyer groups activate or how to engage them.

Pre-pipeline is the missing upstream layer that makes downstream systems coherent.

If you’re looking to add this layer, do check Hiveloop.