Step back to last quarter's management meeting. The pipeline coverage sits at 2.3x when it needs to be 3.5x.

The CEO asks: "What's the plan?" Most CROs give the same answer: hire more SDRs.

It's the conventional, safe move that's been used for a decade. They'll generate maybe 20% more pipeline. Straightforward solution that is approved by the CFO.

Six months later, those three SDRs have ramped. Pipeline goes up a little with more hands on deck. But they've inherited the same manual processes, same static sequences and the same single-threading approach, keeping the conversion rates flat at 5%. The company is just doing more of what wasn't working, only at more capacity.

Here's the decision most CROs don't make explicitly: is the constraint capacity, or is it something else?

The Capacity Math

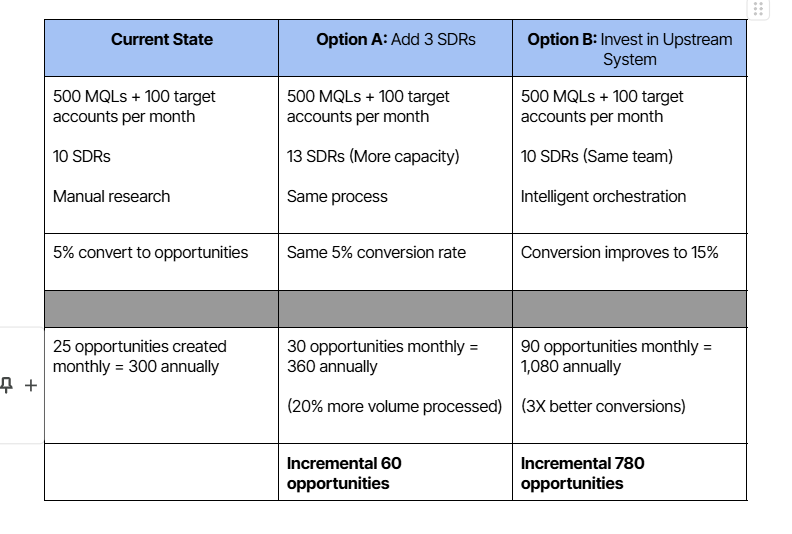

The logic seems sound. Not enough pipeline? Need more people working leads. More calls, more emails.Three more SDRs means each books 5-7 meetings per month if they're good. That's 15-21 meetings. Assume 30% convert to opportunities, giving you 5-6 new opportunities per month or 60-70 per year for the $250K.

But there's an assumption buried in this logic: that the current process works, just needs more hands executing it.

But we’d argue that the process itself is the constraint.

What New SDRs Inherit

Those three new hires ramp for 60-90 days. They get trained, shadowing calls and learning the pitch. Then they start working leads, but inherit exactly what the existing team has:

Cold target lists without any prioritization

Manual research that takes 20 minutes per prospect

Static sequences that can't adapt to behavior

No systematic way to multi-thread across buyer committees

Handoffs to AEs that lose context

They work hard, but their conversion rates match the team average: 5-8%. Because the orchestration layer they're working with is manual, and it’s just more people fighting a broken system.

Six months later: 20% more pipeline. Still 2.8x coverage. Still not enough.

Reframing The Constraint

What if the constraint isn't how many SDRs you have, but how effective each one can be?

The existing 10 SDRs spend 60-70% of their time on research, admin, and coordination. They go after both wishlist accounts and MQLs, and may not get complete context during MQL handoff. Only 30-40% of their time is spent on actual selling conversations.

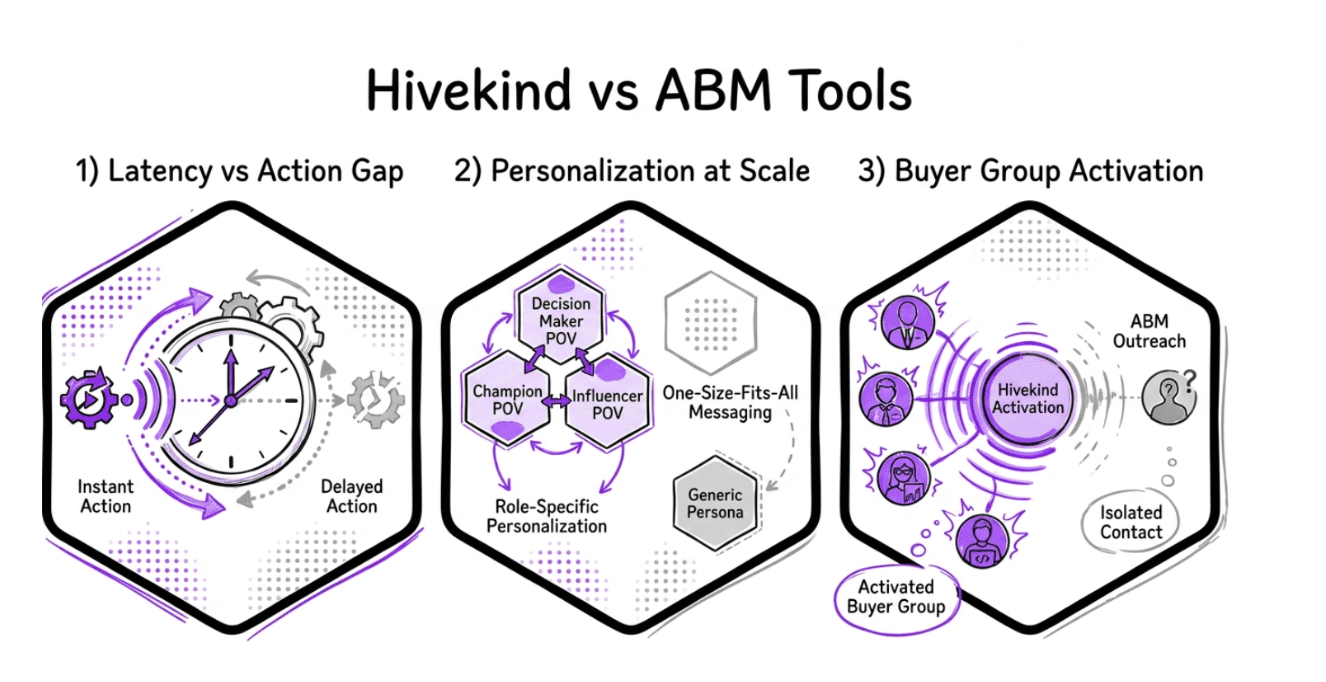

What if we can flip that ratio? By systematizing the work that happens in Layer 2:

Automated research (20 minutes → 30 seconds)

Real-time signal detection (prospects contacted within an hour of high-intent behavior, not 3 days later)

Intelligent prioritization (clear daily list: call these 8, email these 15)

Multi-contact orchestration (buying committees mapped and engaged systematically)

Adaptive workflows (sequences that respond to behavior, not static ones run blindly)

The same 10 SDRs now spend 70% of time selling instead of 30%.

How The Math Compares

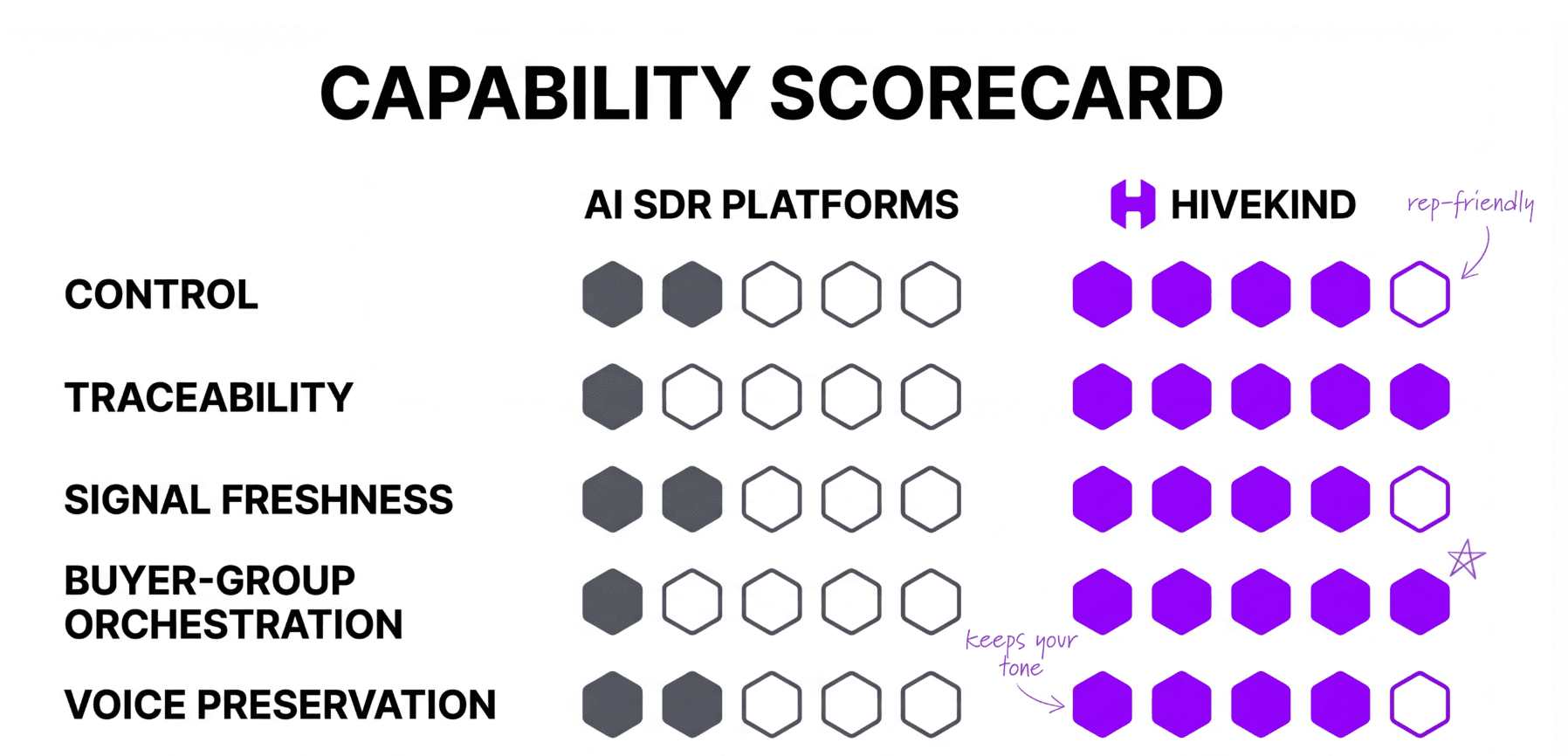

Option A scales capacity on a broken process. Option B fixes the process that makes capacity effective.

If the existing 10 SDRs now convert 15% of MQLs instead of 5%, that's 3x more opportunities.

The Strategic Question

Here's what should happen in the management meeting:

CEO: "Pipeline coverage is 2.3x. What's the plan?"

CRO: "We have two paths.

Path A: Hire 3 more SDRs. They'll process 20% more volume at our current 5% conversion rate. Gives us 60 more opportunities annually.

Path B: Make our orchestration layer intelligent. Our current 10 SDRs operate at 15% or higher conversion instead of 5%. Gives us 780 more opportunities annually.

Right now, we're treating it as a capacity problem. The data suggests it's a system gap.

CEO: "We seem to have the answer!"

CRO: "Yes, we invest in lead generation and sales tools. Not in the intelligence layer between them, which has been mostly manual. And manual doesn't scale.”

This conversation is more evolved than "we need more headcount."

Pitfalls of the Hiring Path

The learning is that one can't hire their way out of a system problem.

If the layer between target account list creation and sales execution is manual, running on spreadsheets, adding more people just means more people fighting the same constraints.

500 prospects times 30 minutes of research each equals 250 hours of work. Your SDRs only have 160 hours per month.

More SDRs doesn’t automatically mean better research. They still use templates, single-thread and miss signals.

The 80% leakage doesn't improve. You just process 20% more volume through the same broken funnel.

Where the Next Dollar Should Go

Most GTM organizations have been over-investing in two areas:

Lead generation (campaigns, ads, content, events)

Sales execution tools (CRM, sequencers, intelligence platforms)

Both are important and necessary.

But this third area that sits between them has been completely under-invested.

The research, qualification, prioritization, timing, coordination, and context assembly that has to happen for leads to become pipeline is humans with some tools trying to keep up with math that doesn't work.

When someone asks "where should our next $250K go," the answer depends on where the constraint actually is.

If you're not generating enough leads, invest in generation. If your tools can't execute, invest in tools. But if you're relying on static decisions, that's a different problem.

The Choice: Capacity or System

Next quarter, most CROs will follow the playbook and hire more SDRs. A few will ask: what if we invested that same money in making our current team 3-4x more effective?

They will question if the constraint isn't how many people they have, but how much of their time is spent on work that should be systematized?

The question is to investigate where the constraint is - capacity or system. The outcomes are vastly different based on where you invest.