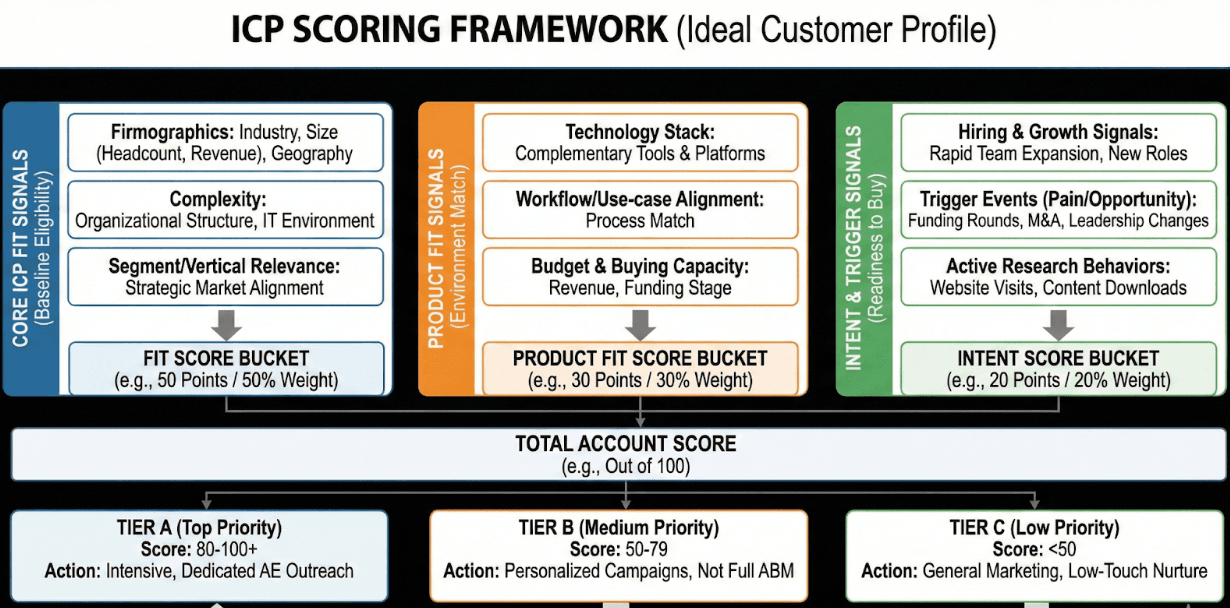

A robust ICP (Ideal Customer Profile) scoring framework helps GTM teams focus on the accounts most likely to buy and succeed with your product . By assigning numerical values to fit and intent criteria, companies can prioritize outreach and resources on high-propensity accounts. In fact, it was found that firms using a precise ICP see up to a 68% improvement in lead-to-customer conversion. In short, ICP scoring turns intuition into data-driven focus: it’s about identifying and scoring the attributes of “best-fit” accounts so sales and marketing can concentrate on the right prospects.

Yet when entering a new vertical or market with no historical win/loss data, this exercise can feel like guesswork. The key is to start from first principles and make educated assumptions, then refine them over time. Early-stage teams often lack past data, but defining an ICP is still critical. The goal is not perfection on day one, but to capture the most important signals and iteratively improve. ICP criteria should “prioritize information about what is important” – and remain a living document to be updated as you learn.

Core ICP Fit Signals

At the heart of an ICP score are fit signals – attributes that define whether an account matches your target profile. Common fit signals include:

- Firmographics: Industry or vertical, company size (headcount, revenue), and geography. These basic facts often distinguish your best customers. For example, you might score a certain sector or size band higher if your product has historically worked well there.

- Complexity: The organizational and operational complexity of the account. Large enterprises or those with multiple business units may require more integration work and cross-department coordination. You might give extra points to companies with complex IT environments if your solution thrives on such complexity.

- Segment/Vertical relevance: Whether the account falls in a strategic market or segment for your company. For instance, if you’re targeting healthcare, finance, or education, you would score accounts in those segments higher. Conversely, accounts outside your prioritized segments can get low or disqualifying fit scores.

In practice, fit criteria form a “gate” for account eligibility. For example, you may require a minimum fit score before an account is even considered outbound-ready. Firms often use firmographics to improve targeting by up to 45%. (Note: in some frameworks, basic tech stack or compliance needs may also be included here, as part of firmographic/technographic fit.)

Product Fit Signals

Beyond generic firmographics, product-fit signals capture how well your solution matches the account’s specific environment and needs. Examples of product-fit factors include:

- Technology stack: What software and tools the company already uses. If your product integrates with or complements their existing stack, that’s a positive signal. For instance, an account using related platforms could get extra points.

- Workflow/Use-case alignment: Whether the account’s business processes match the problems your product solves. For example, if you sell a marketing analytics tool, companies with large marketing teams and data workflows would score higher.

- Budget and buying capacity: The account’s ability to afford your solution. This might be inferred from company revenue or funding stage. Public companies or recently funded startups might score more points, indicating higher budgets. (In scoring, you might assign higher points to firmographic bands like >$50M revenue, or note funding events as triggers – see Intent signals below.)

Product-fit signals ensure you’re not just going after any large company, but those where your product technically and functionally makes sense.

Intent & Trigger Signals

Intent signals capture evidence that an account is ready to buy soon, often driven by business events or behavior. In a new market with little data, focus on broadly observable triggers and interest clues:

- Hiring and growth signals: Rapid hiring or team expansions often presage new software needs. For example, a spike in open job postings (e.g. “10+ new roles in engineering or sales”) suggests the company is scaling and may need tools to support growth. Geographic expansion (opening a new office) or leadership growth (adding new VPs) are other signals that resources are growing. These indicate the company has a budget and new use cases – so we would award points for such hiring activity.

- Trigger events (Pain/Opportunity): Major corporate events can create “hair-on-fire” needs. Funding rounds, mergers/acquisitions, or leadership changes (e.g. new CEO/CFO in key roles) are classic triggers. According to Gartner, accounts responding to triggers like funding or key executive hires have roughly a 50% higher conversion rate. In practice, you might add points if a company just raised Series A funding or announced a new CIO – both signals they may now invest in tools.

- Active research behaviors: If available, look for behavioral indicators of intent (even third-party data). This can include things like company visits to your website, downloads of relevant content, or hiring roles that match your solution domain.

In summary, treat Fit signals as baseline eligibility (“can they be an ideal customer?”) and Intent signals as timely triggers that bump priority. Even if you lack historical analytics, you can list known triggers (growth/hiring, funding, executive hires) and assign small bonus points when they occur.

Assigning Points and Weights

With signals defined, build a point-based model. For each category, decide how many points are available and how to allocate them:

- Fit bucket (e.g. 50 points): This covers firmographic fit signals. For example, assign points for each preferred attribute: +15 for target industry, +15 for ideal size, +10 for preferred region, etc., up to a total Fit score (e.g. 50).

- Product Fit bucket (e.g. 30 points): Allocate points for product-fit criteria. For instance, +10 if the account uses a complementary tech, +10 for matching use cases, +10 for confirmed budget level.

- Intent bucket (e.g. 20 points): Use remaining points to reward trigger/intent signals. For example, +5 for a recent funding event, +5 for leadership change, +5 for hiring spree, +5 for competitor-related research, etc.

The exact weights are your choice. A common approach is to use Fit as a gating criterion and Intent as the accelerator. Many B2B teams end up weighing around 30–50% of the total and intent 50–70%. In a new vertical, you might choose a 50/30/20 split (Fit/Product/Intent) as a starting point, then adjust as you learn. The key is consistency: document how many points each signal yields.

Once points are defined, sum the scores to get each account’s total (e.g. out of 100). For example:

- Industry matches ICP: +15

- Company size in target range: +10

- Using complementary tech: +10

- Recent Series A funding: +5

- Marketing team expansion: +5

- Geography in target zone: +15

- (and so on, summing to 100)

Tiering Accounts by Score

To operationalize the scores, group accounts into tiers (A/B/C or 1/2/3) based on their total score. For instance:

- Tier A (Top Priority): Accounts with scores in the highest band (e.g. 80–100). These are your strongest-fit, highest-potential accounts, deserving the most intensive outreach.

- Tier B (Medium Priority): Scores in the middle range (e.g. 50–79). These accounts are somewhat fit and show some intent. They merit personalized campaigns but not the full ABM treatment.

- Tier C (Low Priority): Scores below 50. These are weaker-fit accounts or those lacking signals; they can be handled by general marketing and lower-touch outreach.

As one example illustrates, on a 10-point scale 8–10 might be Tier 1, 5–7 Tier 2, and 4 or below Tier 3. On a 100-point scale you might similarly break it into 80+, 50–79, and <50. Tiers help sales teams instantly gauge priority and align effort (Tier A accounts might get assigned dedicated AE attention, Tier C might receive only automated nurture).

Example LLM Prompt Ideas

(You can use language models to help brainstorm or apply this framework. This is only the starting point. Over time your wins/losses will help iterate the signals. That’s what we call a living ICP document that changes over time. Example below)

- Prompt for Signal Generation:

"Generate a list of 5 core firmographic (ICP fit), 3 product-fit, and 4 intent signals that would define an ideal customer for a B2B SaaS entering a new industry." - Prompt for Scoring Accounts:

"Given the following two hypothetical accounts with their attributes, score each one on a scale of 0–100 using a model where Fit=50, Product=30, Intent=20. Account A: [industry=tech, size=50-200, uses Salesforce, funding=Series B, 12 open roles]. Account B: [industry=finance, size=500+, uses no related tools, funding=none, no new hires]."

These abstract prompts can help you use an LLM to list relevant signals or even simulate a scoring process. (Just replace the bracketed examples with your actual vertical and attributes.)

Conclusion

Building an ICP scoring framework from first principles is about crystallizing your assumptions on who is most likely to buy and succeed. Start by listing the Fit, Product-Fit, and Intent signals that logically matter for your business (even if you have no data yet) and assign relative weights based on strategic priorities. Document the scoring logic and segment accounts into clear tiers.

As you gather real results, refine the model continuously – remember, an ICP is a “living document” that improves as you learn. Over time, this disciplined approach will help your GTM team focus on the right targets and accelerate pipeline in any new market.

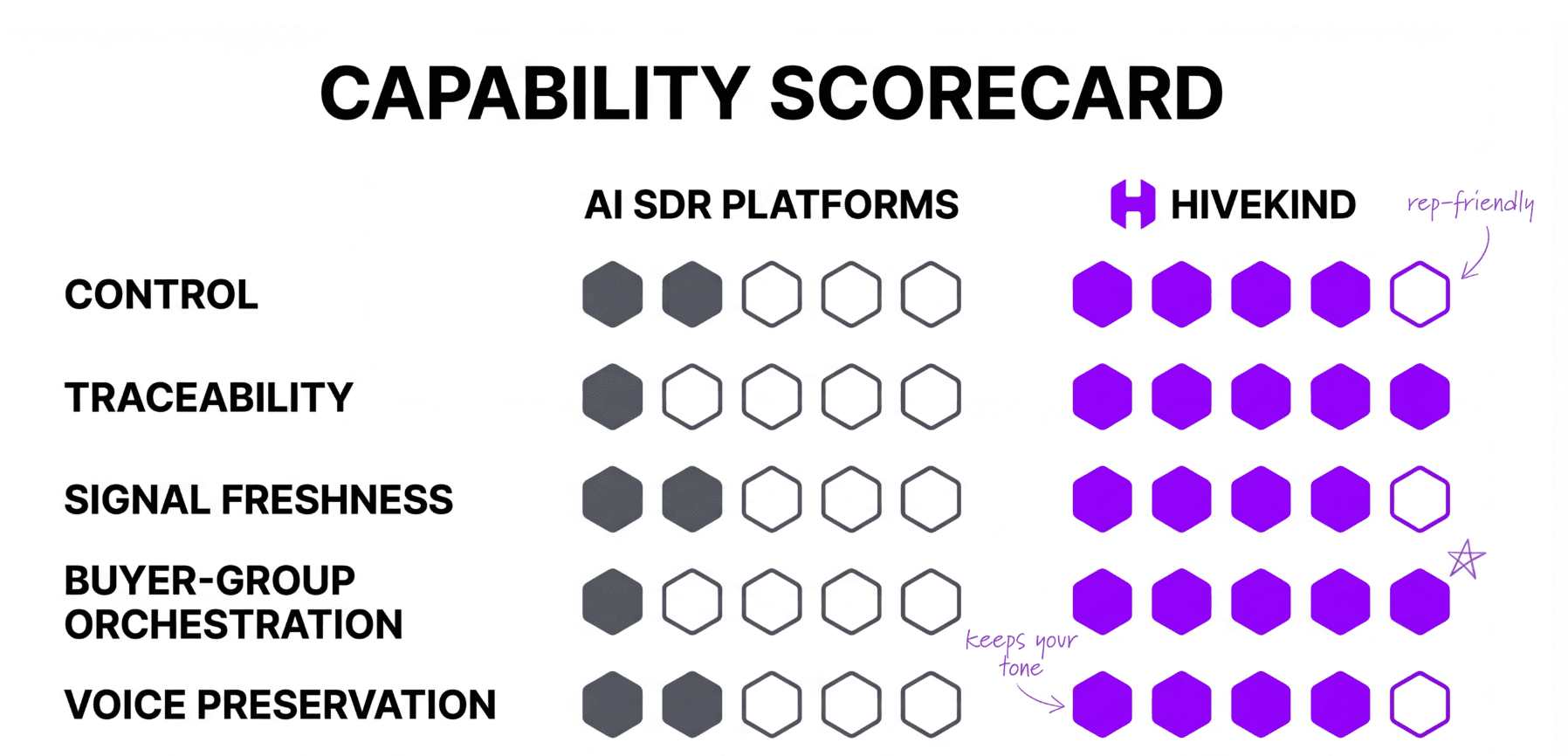

Next, we will cover how a you can refine the ICP model continually as AI learns more about your customers, prospects and the kind of responses you are getting.

If you are a B2B SaaS company and want help in setting up this ICP scoring system for your team, let's chat.